Since the appearance of digital currencies and Blockchain Technology, their disruptive character has moved more and more into the focus of Central Banks and Financial Authorities. The technology enables to generate and manage decentralized currencies. Currently, the European Central Bank (ECB) is openly discussing the development of a Central Bank Digital Currency (CBDC). The ECB expects an electronic Euro within the next five years.

The German Bundesbank has concerns about a rush introduction of digital central bank money. The Bundesbank is of the opinion that at first, we have to understand positive and negative sides of CBDCs before we decide whether a CBDC is needed and, whether the risks of such a currency can be controlled. With regard to the manufacturing industry, the Bundesbank raises the question of whether it always has to be the state that implements a solution, the private sector is increasingly demanding - the digital-programmable Euro.

Possible drivers of Central Banks for CBDCs

With the emergence of private means of payment in the form of cryptocurrencies, Central Banks getting under increasing pressure to provide something comparable. They must be worried to lose the leverage, which was given to a Central Bank by the state monopoly on money. The task of a Central Bank is on one side to provide a reliable and secure payment system, on the other side to pursue monetary policy in order to stimulate the domestic economy. This works only if citizens use their own currency.

As long as private cryptocurrencies are volatile like Bitcoin and used as an investment more than as a means of payment, Central Banks are not challenged. The application for a license of the Libra Association (now Diem) at the Swiss Financial Market Authority (Finma) as payment service has triggered further discussions with Central Banks in direction towards a CBDC. The underlying crypto currency Diem is designed as a stable coin. Insofar the coin is linked 1:1 to the exchange rate of e.g. the US Dollar, Euro or Swiss Franc.

The Diem Association states that their business model aims to make international transactions regarding remittances - in the area of financial inclusion - more attractive and to give so-called unbanked people access to financial services. The Diem could therefore become a challenge for the monetary policy of Central Banks in emerging countries, if citizens start using Diem heavily, because it is attractive due to a peg on stable currencies.

The Peoples Bank of China is already testing a CBDC, the so-called Digital Currency Electronic Payment (DCEP). The Central Bank admits publicly that Diem is the real driver to introduce the Chinese DCEP even faster. Obviously, China has great respect regarding a digital currency from the US private sector that is supposed to be pegged with the US Dollar. In mature markets relying strongly on a manufacturing industry, concerns arise about losing touch with technical innovation. The concern, of being confronted at some point with the fact that the digital Euro could run on the technology of some Diem-Association or a Chinese technology because of a lack of own development, forces us to act.

For the US Federal Reserve Bank, the challenge is to secure the US Dollar as the global reserve currency against the emerging DCEP from China. However, the FED reacts unemotionally regarding the development of a digital US Dollar.

Cash must be maintained

Money is of great importance for all of us. Therefore, we need a debate about what kind of money we want. We need to understand what exactly CBDCs are and to balance the impact of the CBDC introduction on our financial system and on the citizens. The introduction of a CBDC does not necessarily mean the abolition of cash. There are good reasons for a continued existence of cash, as certain advantages for citizens cannot be represented in a digital form.

CBDCs enable negative interests. If the use of cash as a store of value is diminished by negative interests, banks reduce the digital amount of their central bank account and bank customers change their deposit money to cash and store the physical form of money in high-security vaults. But this would no longer be possible, if cash were completely replaced by a CBDC. Without the existence of cash, negative interest would lead to a purchase of precious metals or any other commodity money of value as a store of value. Such valuables are even stored in high-security bonded warehouses for trade reasons and to avoid even taxes. We observe this phenomenon already today.

CBDCs open up opportunities that may affect privacy, but which are not desired in constitutional states. In this respect, the existence of cash in a society organized under the rule of law depends on whether peoples demand cash or not. This requires information and an objective discussion with the citizens. Experts should conduct this discussion interdisciplinary.

The cost of cash and of digital money

In any case, it would be a mistake to believe that digital forms of payment are not charged in any case or would not be charged even higher in future, if cash disappears. Costs arise for the set-up and maintenance of a digital infrastructure, for security architecture against cyberattacks and redundancy systems – even in the event of power failures. But also interests could be charged for a CBDC to the citizens, although cash does not bear any interest.

Cash incurs costs due to its physical handling, e.g. transport and security. ATMs and cash desks at branches are often mentioned as cost drivers and considered to be not profitable. The economically relevant expenditures are the production and destruction of banknotes. In Germany, a banknote changes in average 144-times from one to another before it will be destroyed, and a banknote has to be processed six-times within the life cycle by the German Bundesbank plus by other players involved in the cash cycle. At least cash has to be attractive enough that the advantage, cash has over its digital complement, and the costs that arise for cash, are well-balanced. The cost for a solid minimum cash infrastructure should be accepted, because such an infrastructure must be flexible enough to be adapted to the respective cash demands. In times of loss of trust, such as financial crises, the demand of cash can increase suddenly.

Undesirable costs for cash arise mainly because processes are often still carried out manually. The cash cycle is also characterized by generally low degree of digitalization with regard to the use of software and a lack of standardization and automation. There are already several intelligent models that have been developed which can shorten the cash cycle and therefore, cost-savings can be achieved. Unfortunately, such systems have not yet been implemented or not implemented on a large scale. With regard to a cost reduction in the cash cycle, the legislature could certainly make efforts as well. Requirements for participants in the cash cycle could be replaced by a stricter and continuous practice of supervision by supervisory authorities. Banks would have to exercise their control over their outsourcing partners restrictively. In addition, sufficient insurance coverage should encompass the entire process, including the digital one, and to be mandatory. This would also apply for service providers to the same extent.

Working on a Wholesale or Retail CBDC

A study by the Bank for International Settlements (BIS) among 66 central banks showed that 80 percent are currently working on CBDC projects. With regard to the tested technology of a wholesale CBDC versus a retail CBDC, the survey shows that the majority of central banks are working on a retail CBDC. Ten percent of Central Banks even announce that they will launch a CBDC within the next three years.

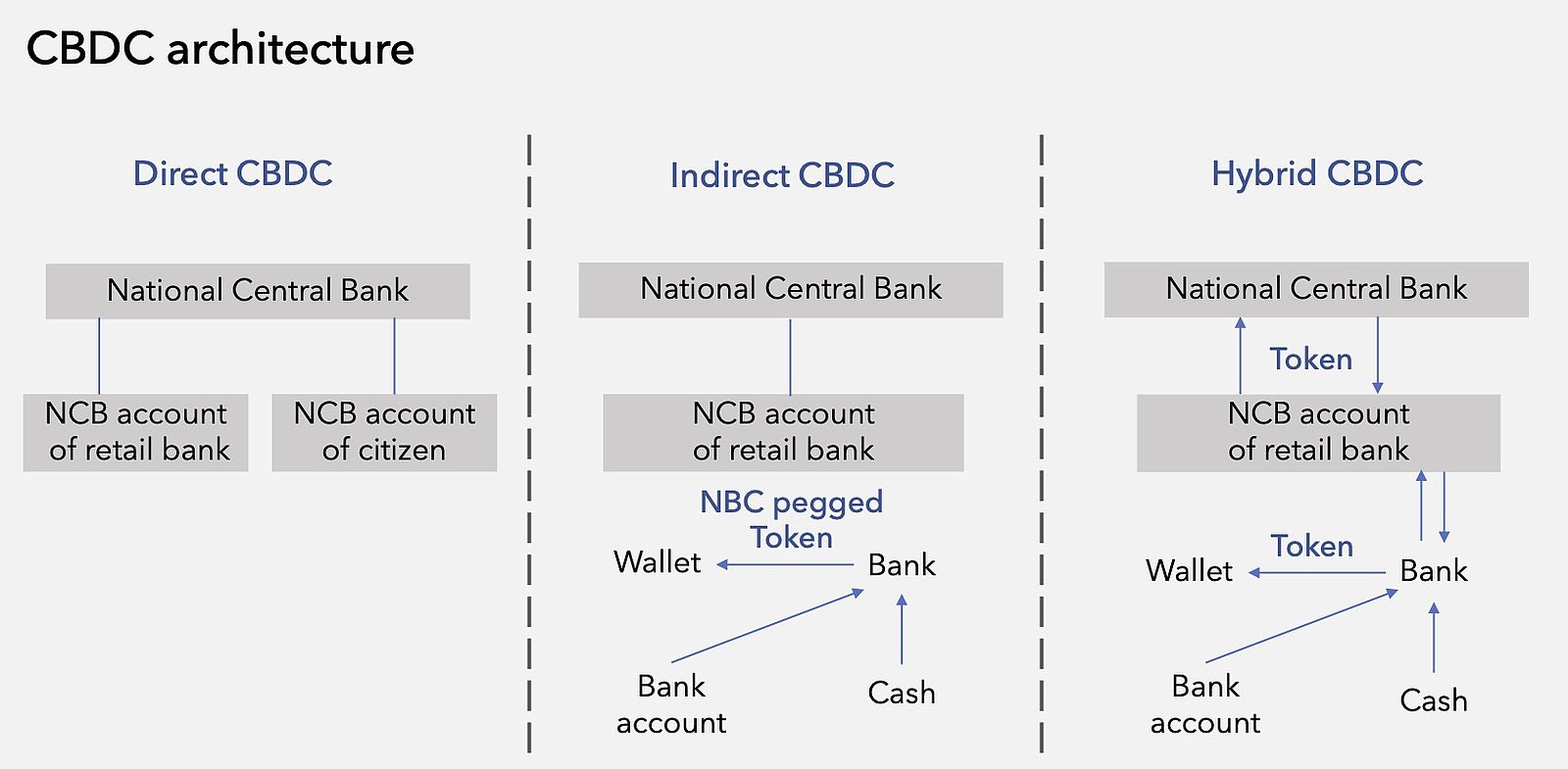

A wholesale CBDC is a pure interbank construct in which only banks trade the currency with one another. A retail CBDC represents a CBDC to which everyone has access, including end users. With regard to the technology on which the entire currency system should be implemented, the question arises whether a CBDC should be implemented on a blockchain basis or on a conventional database. Most Central Bank projects relate to Distributed Ledger Technology (DLT). Whether DLT is needed, depends on the use case and whether centralization or decentralization is desired.

Use cases of a CBDC

The ECB, the Central Banks of Canada, England, Japan, Sweden and the Switzerland formed a CBDC Task Force together with the BIS, and the research group works out possible use cases for a CBDC.

From the point of view of Central Banks, the private sector or other end users, possible reasons for the introduction of a CBDC are:

- The demand for cash at the point of sale is decreasing sharply

- The aim is to reduce costs in e.g. the Eurosystem

- One would like to eliminate the intermediary, e.g. commercial banks

- Free access to the financial system to offer unbanked-people financial inclusion

- To support monetary policy in emerging countries

- To support financial stability in mature markets

- To achieve fast and cost comparing, international transactions regarding remittances and financial inclusion

- The aim to simplify international settlements

- Non-Euro payment forms are gaining strong interest (e.g. Diem-Stable-Coin).

- Enabling machine to machine and IoT payments

CBDC as an image of cash

CBDCs have a legal and a technical dimension. Legal tender is anything recognized by law to settle a public or private dept or meet a financial obligation. A creditor is generally obliged to accept legal tender. Regarding taxes, the only way to make tax payments is with legal tender. CBDCs concern not just the Central Banks, but furthermore the Ministry of Finance if coins and taxes are considered.

A CBDC must be created as a substitute or as a complement to physical cash in a digital space. This requires that the properties of physical cash are mapped as well as possible in a digital manner. The ECB announced the digital Euro as a complement for cash. This considers a digital Euro as a token. A CBDC will not be a simple transaction recorded in an account. It is an asset that changes the ownership as a result of the transaction. According to the ECB, people outside the European Union (EU) should have access to the digital Euro. However, there should not be unlimited access outside the Euro zone, so that exchange rates or capital flows do not change substantially.

The feature of anonymity

The anonymity-feature is another important component of cash, although full anonymity is not possible with either cash or a CBDC. The right to make anonymous payments at least up to the threshold of what is legally permitted, must remain as granted. Design decisions play an essential role.

Regarding DLT, the dimension of anonymity and the dimension of decentralization should not be mixed up. Users of private cryptocurrencies create trust through trust in the respective technology. They argue that anonymity is not possible in a CBDC system because the end users do not participate in the DLT of the CBDC. But this argumentation is not entirely correct. For sure it is true that not every participant has access to the database and is able to download the general ledger. But this simply means, that the CBDC would not be decentralized and the citizen must continue to trust in the Central Bank to carry out payment transactions properly. But this is regardless whether the payments can be anonymous or not. The technology enables to make anonymous payments by proofing against the Central Bank that the payment is below a permitted limit, e.g. with a so-called zero-knowledge-proof. The problem of copying (double spending) does not arise when a Central Bank controls the process.

Risks for privacy and for the banking system

Digital transactions generate data traces, and we pay for the use of digital systems with our data collected by companies in the form of a barter deal, data against services. In future, we will surely achieve more control over our data through to legal regulations.

There is a risk of disintermediation for the banking sector. As soon as there is a digital central bank currency there could be an outflow of bank money from the banking sector into CBDC, because there is not really a risk of default at the side of the Central Bank. This could be critical in times of crises. The ECB wants to introduce measures to prevent the outflow of bank money or to raise so-called penalty interests.

There is broad consensus among Central Banks that banks should continue to play an important role in the form of a two-tier system despite the CBDC. Central Banks see themselves more in the role of a regulator and provider of a basic infrastructure. The interface to the customer should be still managed by banks. This means that banks distribute the CBDC and build up customer applications, take over the on boarding of customers, the Know Your Customer (KYC) process and the control over money laundering and anti-terrorism regulations. The user will be able to download a wallet from the bank. The CBDC deposited at the bank could be loaded onto the digital wallet, just like bank money from a bank account. In order to increase resilience if the internet fails, the CBDC should also be usable offline.

Outlook

Digital payment methods gaining importance. Therefore, the cost of cash must remain balanced in comparison to digital payment methods. Decreasing cash demand requires a minimum cash infrastructure that react flexible on fluctuations in cash demand but must remain still efficient in order to preserve cash as legal tender with its physical advantages.

Regarding the introduction of a CBDC, the question about the Use-Case arises and subsequently whether the basic infrastructure of our future digital legal tender will be offered by Central Banks. Central Banks will weigh up and examine the DLT. In doing so, they will also take into account, as in the European Union (EU), that efficient real-time payment systems are already in place. It certainly does not make sense to replace one good system with another just because it is possible. DLT platforms, which are compatible to international settlement payment systems are a first step. Tokens will be transferred as proxy by Central Banks instead of fiat currency. The race for the digital base layer of our future payment system has begun although the introduction of CBDCs however, is far from being finally decided.

Sources:

Deutsche Bundesbank: Jens Weidmann sieht Chancen und Risiken digitalen Zentralbankgeldes, 14.09.2020; ECB: ECB identifies its work on a digital Euro, 02.10.2020; ECB Paper: Anonymity of CBDCs; Positionspapier des FinTechRat; BIS Working Papers: No 880 by R. Auer, G. Cornelli, J. Frost, 24.08.2020; BIS: Update around the world, Dec. 2020; Libra White Papers; Diem website; Positionspapier Bankenverband, 30.10.2019.