The banking and transport sector are challenged by overall paradigm shift to reduce the ecological footprint. The cash eco-system has to consider the production of coins and banknotes and its operations along the cash cycle. The cash operations have an impact of nearly two third on the environment and is in focus on each debate about advantages and disadvantages of cash. Minimizing the environmental impact along the cash supply chain with transport and cash centers is a major criterion for prospective decision making. For this reason, quality, punctual delivery and price shall be extended by a factor of sustainable green logistics.

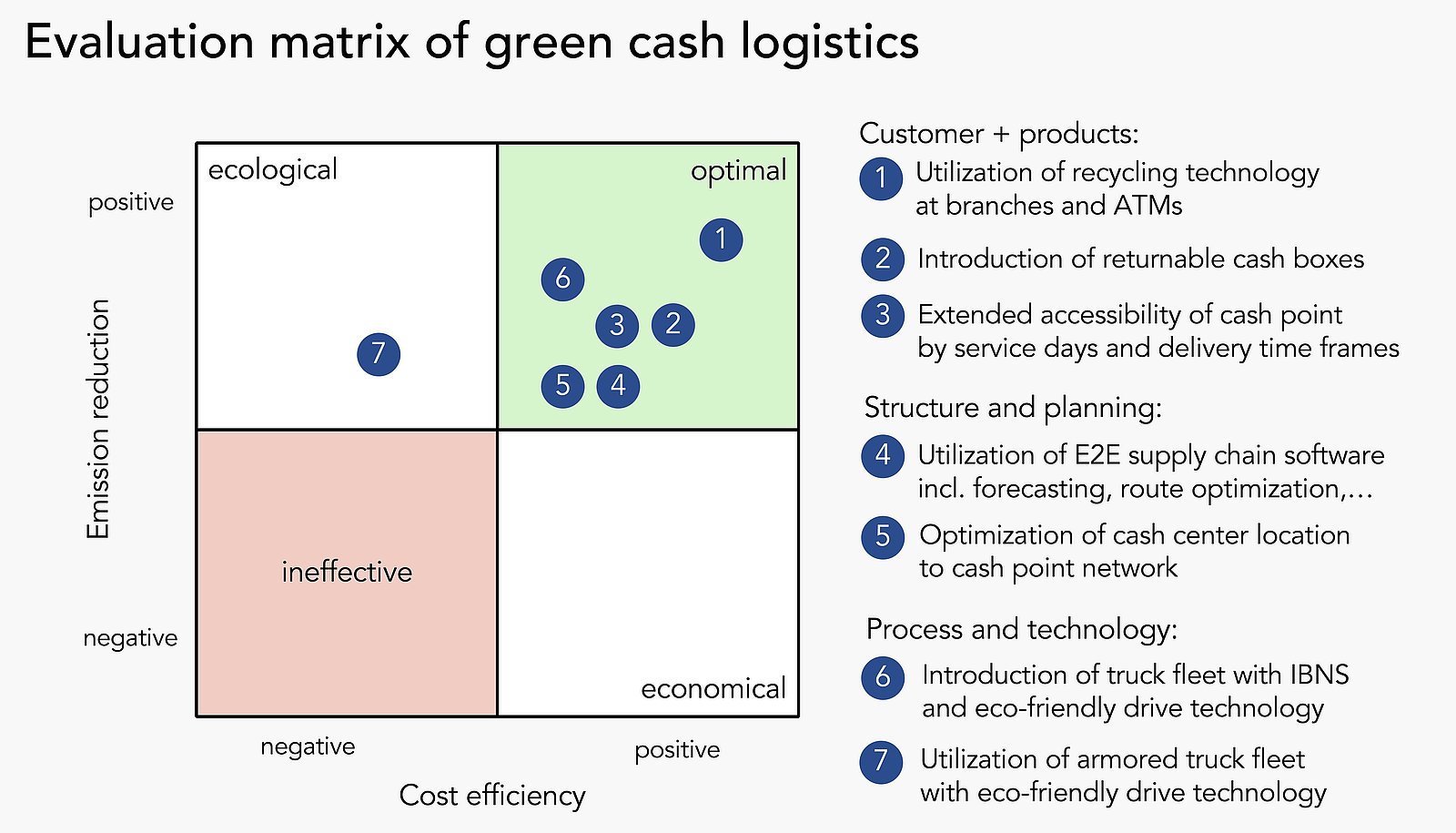

The targets have not to contradict each other. A higher level of digitalization or returnable transport boxes in connection with automation along the cash supply chain offers untapped potentials in cost efficiency and substantial reduction of emissions. Inefficiencies due to immature supply chains are still common in the cash-in-transit business (CiT). The digitalization level of scarcely 40% in the global transport sector is lagging behind other industries because the supply chain is often not in focus of the digital strategies of Central Banks, commercial banks and CiT carriers. In the CiT sector, the results are known: a high rate of emergency orders, late deliveries, extra routes and costs by incapable order management and route planning tools supporting only fixed route schedules across the week. The lack of digitalization has an impact on cash center operations with an excess of cash inventory, waiting time at cash center receiving and shipping bays, lost time in processing. All this quality gaps based on missing planning data and tools and therefore latency of decision making. Living in a land of immaturity is stressful for each supply chain planner, and the inefficient process leads to higher costs, missed quality levels and no time for implementation of “green logistics”. A focus on “electric drive” of armored trucks is therefore an action to reduce the dependency on fossil fuels in transport, but other measurements have a higher range of influence.

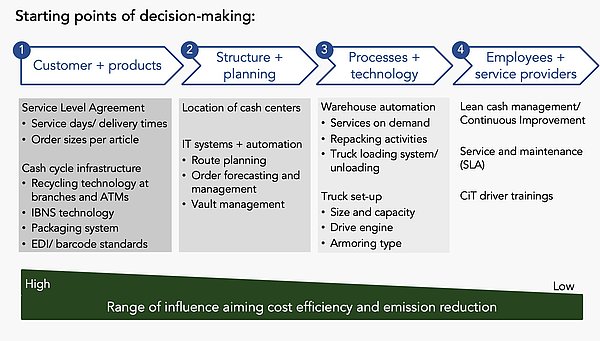

Starting points of decision-making aiming cost efficiency and emission reduction

The transformation process of green cash logistics should consider a holistic end-to-end approach. The actions can be assigned to various decision levels which have different impact to range, scope, maturity, capital expenditure and resource requirements.

As an example, the packaging type determines the size and weight of the defined cash products/ articles and consequently the amount of transport units per shipment. The packaging of banknotes in packets, in bundles or loose into safebags or cash boxes define in following the maximum packaging density per container or truck and subsequential in next decision level the space for storage in vaults or the amount of transports. The environmental impact – measured by CO2 emission per transported cash product – is strongly influenced by required packaging type and size of the transport unit. Actions on route planning may have an optimization potential but must consider the parameters of size and weight of the transport units in all further logistics processes within the cash cycle.

Another example with a high range of influence to cost efficiency and emission reduction are defined between the client and the service provider by delivery and pick-up time frames per cash point. Narrow time windows have high restrictions on route planning, so an extended accessibility of cash points enables the CiT carrier to react more flexible and faster on changes in order volumes. The todays’ norm of fixed route schedules can be replaced by a dynamic route planning with optimized route and inventory management per cash point. The service days with pick-up and delivery time frames - defined in the customers’ agreements - determine consequentially the route structures and daily planning processes with high impact on CiT fleet utilization including pricing and ecological footprint.

Sustainable approaches with a positive range of influence

1. Cash recycling technology at branches and at ATMs

The demand for cash delivery and pick-up within the network of branches, retail stores and ATMs determine the transport routes. A low stop frequency and a shorter distance between the stops and to the next cash hub/ center, both factors have a positive impact on cost and on environment. An optimized cash recirculation can be leveraged on level of recycling ATMs, on level of in-branch cycles and within the network by direct exchange of cash stocks between cash positive and cash negative cash points. All three levels contribute value add to increase stop and transport efficiency in combination with cash forecasting and dynamic route optimization software by not less than 40% depending on size of network, customer cluster and cash volumes.

It is remarkable while automated and reliable cash recycling technology for ATMs and assisted self-service/ automated teller terminals for branches is available since more than one decade, the potential is still unused in major world regions with banks discouraged by poor note quality or dependent on non-adaptable IT legacy systems. Whereas Japan began embrace cash recycling back in the 1980s and deployed ATM recyclers today at nearly every cash point, other countries are on the start line of implementation, including Brazil, Mexico, Russia and the region of Central Asia, or India. The recycling technology plays an important role in banks’ transformation projects.

2. Optimized packaging system based on returnable cash boxes

Worldwide, banknotes and coins are mainly packed and shipped in non-reusable transport units like safe-bags or cardboard boxes. But the normal order structures in many markets show a phenomenal potential for returnable cash boxes with a recirculation rate per transport unit of 70% to 85% for bank branches, of 100% for ATMs with service through cassette swap, and also for retailers the boxes can reach a rate above 50% because many retail shops request frequently coin exchange. Also, the wholesale cycles of Central Banks are organized with heavy cardboard boxes for notes or containers for coins delivered from printworks and mints on pallets, all this transport units are usually repacked at each cash center to fulfill the different order sizes of the commercial clients.

Why do all these organizations focus on one-way packaging and prevent returnable transport units, if the cash boxes will circulate up to once each week with ecological and economic benefits?

Returnable cash boxes are available in the right size for wholesale cycle of Central Banks and branch cycles. The units are tamper-proofed, robust and adapted to manual handling with a max. weight of 15kg, sufficient for 10’000 notes. The design is compliant to automated handling in automated storage and retrieval systems (ASRS), conveyors, AGVs and to automated truck loading and unloading systems using sufficient trolleys.

The reason is often an immature supply chain software with a functional lack for a container/ box management. So, the container management is carried out manually and are neither standardized nor integrated. The weak transparency about box movements and inventory in the network results in a situation where cash boxes are located at the wrong places and go missing. A digitalized container management based on smart, connected cash boxes with electronic seals and logistics software tools, both systems compliant to GS1 international standards for box identifiers, data capturing, and data exchange solve these downsides and optimizes the recirculation rate of and investment in cash boxes, eliminate loss of boxes, reduce costs for empty box handling, avoid auxiliary costs for alternate packaging.

3. Mature supply chain software supporting an integrated E2E cash logistics

Digitalizing the cash logistics is a key differentiator. But many companies facing the difficulty to gain the expected potential due to not closed technology gaps and management choices. Technology gaps mean that companies streamline routine activities, e.g. order placement by using web-platforms or manage the deposit processing workstream, enhance analytical practices through cash forecasting tools, but value add is mostly connected to combined operational changes. For instance, forecasting tools offer substantial savings by reduced cash inventory and stop frequency, but the service provider is not able to support a dynamic route planning and execution without a decline in service levels. Also, the implementation of returnable cash boxes can fail if the technologies are not in place to support the new operations.

The right approach to digitalize the cash supply chain integrates suitable technologies and redesigned operations. Many managers are familiar with the basic transformation process: defining a vision for the future operations, checking the current situation and develop a transformation road map. A digital transformation requires additional features to be successful. The “to-be” scenario will call for a combination of utilization of “no-regret” improvements and changes which can be further developed over time into the targeted vision. The “as-is” evaluation should consider whether operations and technology are supporting an end-to-end process, and weather the organizational structures are adapted to encourage a continuous improvement process. In addition, the time plan of the transformation path is compact with the possibility for upgrades to latest digital solution.

4. CiT fleet with IBNS technology in connection with eco-friendly drive

The route distances in metropoles are generally not longer than 150 km per daily shift, an optimal distance for trucks with full electric drive. Such a “green” truck has no-emission in comparison to trucks with combustion engines and less noise pollution, ideal for inner city cash deliveries and pick-ups. However, the fully armored CiT truck with an eclectic drive has a higher unladen weight in comparison to truck used up to present. The cargo weight of the eco-friendly CiT van is reduced by approx. 300 kg, if the van respects a limited gross weight of 3.5 tons necessary for accessing city centers in Europe and modern metropoles worldwide. This means that highly efficient routes servicing banks, retailers and ATMs in inner cities must be split into routes with a lower load and stop density. The ecological advantage of this technical set-up is gone or becomes negative.

The future technical set-up targeting a modern electric truck fleet must consider a lightweight composite material for effective armoring. In comparison to steel armored vehicles, the composite panels optimizing the weight to ballistic/ protection performance ratio required for the different international markets. The lower weight of lightweight composite trucks compensates the additional battery weight of electric trucks and vans, reduces the power consumption and the wear of chassis with positive effects to service and maintenance costs of the CiT fleet.

The same benefits are valid for lightweight soft-skin vehicles equipped with IBNS technology (Intelligent Banknote Neutralization System). The IBNS technology uses the inherent benefit that banknotes are secured by ink dye in cash boxes/ smart trays on transport and over pavement operations. In case of unauthorized access and openings, the banknotes are reliable stained and therefore valueless at each attack or internal fraud. As a result, more and more countries worldwide accept, or mandatory regulate the introduction of IBNS in cash logistics. The transformation road map for IBNS can consider additional efficiencies in operational planning of routes and truck crews. The deterrence against attacks with access to cash allows to reduce the truck crews by the guard persons. The route planning can be structured highly effective on hub-spoke models. For instance, shopping centers with multiple pick-ups can be served by two messengers, executing the cash collections in parallel as the IBNS protected truck will be parked on a controlled and secured perimeter.

Conclusion

The examples show effective actions with concurrent ecological and economic benefits. The list of measures can have different starting points, where the determinations on customer and product level obtain the largest range of influence. Central Banks affecting the performance within the cash cycles by setting their regulations in terms of clean banknote policies, offered cash articles and services, accepted and supported packaging systems and interoperability standards for electronic data interchange (EDI) and data capturing (barcodes/ RFID-EPC types). The effects of an improved cash recirculation within the branch cycle up to the terms of fixed service days and narrow time windows for deliveries and pick-up of cash are still underestimated by customers with environmental green commitments. The agreement on future-driven standards of mature IT software systems and IBNS for end-to-end cash protection determine subsequently cash infrastructure and operations of client’s organization and its service providers. The contract management including Service Level Agreements between the parties is therefore a key element and should reflect the objectives in price and quality but support also the deployment of modern technologies and its roadmap reaching benchmarks for a green logistics.

Do you want to know more about recirculation concepts for branch and ATM networks, design of optimized packaging systems, selecting of returnable cash boxes, mature cash supply software, or the set-up and procurement of future-oriented CiT trucks, please contact us.