Dozens of logistics technologies are under development. Different vendors offer their own variants, so there are hundreds of different opportunities on offer today. Media hypes AI, robotics and blockchain technologies for implementation, but none are yet in widespread use. The question that affects cash supply chain managers is simple: Which technology will take off to gain return on investment in future? Finding answers could be difficult, because no one wants to buy technologies that becomes obsolete after acquisition. For example, radio-frequency identification (RFID) tags promised to provide a real-time perspective on each delivery item from production to customer, revolutionizing also track and trace, and consequently security of the cash supply chain process. In practice, higher costs for safe bags and missing interoperability along the supply chain have limited the use of technology to niche areas. As in the past, the feasibility and potential benefit of new innovations has to be checked for the users.

Technologies to watch

Technology implementation should address the specific problems of the user, avoid pain and achieving rapid impact. These factors minimizes risks and pushes „go-decisions“ of a new technology approach. Therefore, we watch out for accessible technologies - with high rate of implementation by suppliers and high level of acceptance by end users - which can be transferred from other industrial sectors to the cash industry. Following technologies set trends for cash logistics:

1. Automation and logistics standards

Many cash handling processes can be standardized and therefore automated. Analyses throughout National Central Banks show that withdrawals and lodgments of local currency comprise mainly not more than 50 articles, and the transport units can circulate within the regional cash cycles. This allows to introduce standardized, returnable and tamper-proofed cash boxes, carrying an amount of 3’000 to 10’000 banknotes. Size and weight of such box types enable a manual and automated handling without limitations.

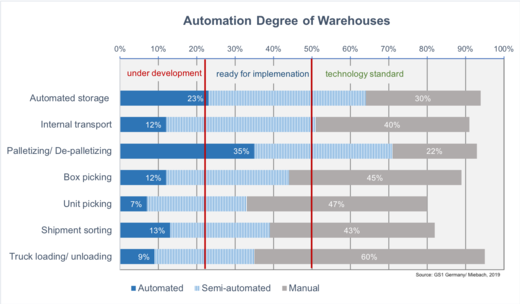

Todays’ automation and robotic systems are more capable and flexible than ever. We expect automated Cash Center vaults, typically used with an automated storage and retrieval system (AS/RS) that moves the cash articles in boxes or on pallets in/out of the high security areas without human intervention. Cash Center Management Systems will keep track of inventory in real time, ensuring it matches to the ordering system. Automation will further improve the goods handling, e.g. receiving and shipping can be controlled by optical recognition where sensors scan items checking box integrity, box-ID and seal-ID. In this respect, RFID can complement track & trace by transmitting the shipment-ID of the load.

Cash Center automation projects are in future not only a reserve of specialized hardware and software companies. Now, manufactures of conventional material handling equipment adding automation and sensorics to their products; robotic companies and their system-integration partners supplement end-to-end solutions.

2. End-to-end cash visibility

Increased standardization in auto-ID and data communication by EDI like GS1 Standards for cash logistics enables all cash players to build, adapt and integrate the software and systems into their organization. This ensures interoperability between the players along the supply chain and frees each operator from dependence on a single supplier. It improves to select the best-in-class solutions or to develop in-house applications.

Modern Cash Management Software can integrate robotic systems, analytics, performance reporting and forecasting tools, allowing supply chain managers to easily control the entire operations. Applications for analytics support operators to analyze machine performance (Overall Equipment Efficiency/ OEE) and set maintenance routines, or to identify optimal order size and volumes to predict order characteristics for ATM replenishments to improve speed and accuracy of delivery for on-demand services.

3. Dynamic transport networks

Many CiT carriers offer order lead times of 2 to 3 days until delivery, they freeze their transport schedules over months, or minimum weeks to match price expectations of the clients. Such inflexible service levels are not successful, if real-time planning allows competition to respond dynamically to changing requirements. Dynamic route planning systems are a must for each CiT carrier.

A reduced cash utilization in retail shops and bank branches leads to higher individualization and cost pressure in mature markets. The Cash Center operators and CiTs must manage the demand at a more granular and accurate level, means handling of more but smaller shipments. The mass customization requires improved delivery and pick-up networks and more-sophisticated scheduling practices. For cash warehouses, a predictive preparation of tamper-proofed boxes with predetermined household mixes is a first step, in combination with AS/RS the boxes can be delivered from vault to the CiT trucks on demand, even if the order is placed a few minutes before the truck arrives at the center.

In next step advanced software supporting regional cash marketplaces, where demand and supply are matched in “real time”. CiT carriers can offer free transport capacities, pushing utilization up and costs down; smart customers depend not any more on a single carrier, banks and retailers can shift their order volumes between two qualified vendors, especially for seasonal peak times.

Conclusion

New technologies and systems like automation, robotics and end-to-end software applications are changing how companies think about their logistics organization. That’s becoming more important as commercial banks and retailers expect flexibility and customized services from CiTs, Cash Center operators - but also Central Banks. Behind the scenes, these advanced service levels require an accurate, real-time view of inventory across the warehouses, transport and branch networks together with efficient processing capabilities to minimize backlogs and fast picking and order preparation ready for on-demand services.

Within that imperative, following questions are faced and answered by feasibility concepts:

- Which process steps should be automated?

- What kind of automation system and software should be installed?

- How much capacity can be handled by these systems?

Do you want to know more about automation of Cash Centers and CiT logistics, please contact us.

Sources:

Cash InfraPro analysis and performance programs for cash cycle optimization, GS1 in Europe, McKinsey studies